Closing Financial Year

A financial year is defined as the period in which an organisation calculates its annual financial statements (e.g. In Australia the financial year 2022 is between 01/07/2021 to 30/06/2022).

When a financial year is closed, the Capital Expenditure of each asset is cleared for the next financial year.

The Capital Expenditure in the current financial year is saved in the database for generating past year reports.

Closing the financial year will prevent any valuation data from being changed for the given financial year.

Recommended to be only be performed when the auditor has signed off the financial books.

Scenario A: A User chooses to do either a revaluation or indexation to one or many asset categories before the close of current FY. Perform close (1).

The system will generate the required balances and will store the calculations in the database.

This closing operation is not the final operation, as the User wants to do a revaluation.

The system will prompt the User after completing the Close 1 whether they want to revalue or index the assets.

Generate the AFR before any operations.

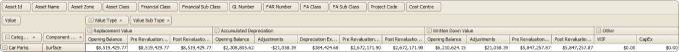

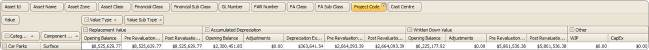

Below is the AFR for Car Parks before closing the financial year:

Close 1

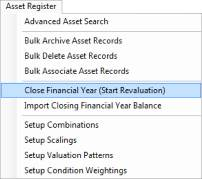

Under the Asset Register menu, click Close Financial Year (Start Revaluation)

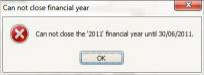

The following screen will appear.

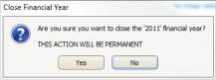

Select Yes to proceed.

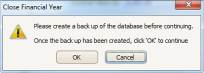

Click OK after creating a backup of the database.

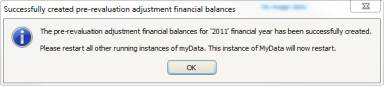

This has partially closed the current financial year in myData.

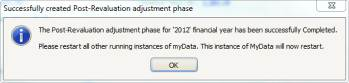

Once myData restarts users can choose to revalue or index their asset categories.

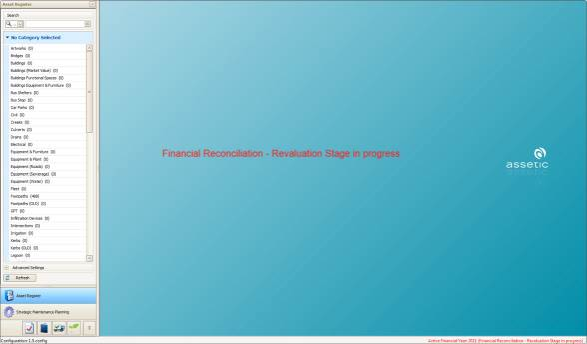

The following screen will appear once myData restarts:

Users can now either update Unit Rates manually or can import data.

In this scenario we will change the unit rates for all the assets to Current URR ($) + $100.00.

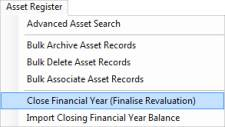

Once this new data is imported click Close Financial Year (Finalise Revaluation).

Any other data updates can also be done during this stage.

Note: If data updates that will affect valuations are done then the Valuation Date should always be updated and it should be 30/06/20XX, where 'XX' is the current financial year.

Generate the Closing Difference Report from myData.

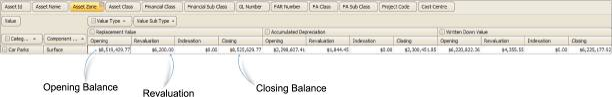

This will show what the assets were opened with (opening balance) and any revaluation figures and the new closing balance.

Reporting

The report shows the Opening Balance, Revaluation and the Closing Balance.

The same details are also available in the AFR.

Close 2

Under the Asset Register menu click Close Financial Year (Finalise Revaluation) Option – Close 2.

The following screen will appear:

Create a backup and click OK.

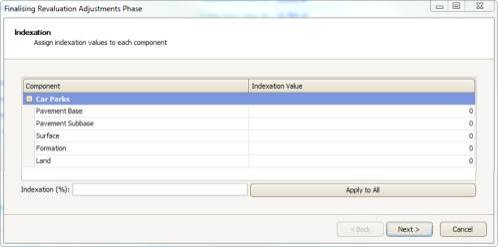

The following screen will appear:

If required, Users can add indexation values for each component or add a percentage value to be applied to all assets and each asset component of those assets.

If there is no indexation values to be populated skip this page and click Next.

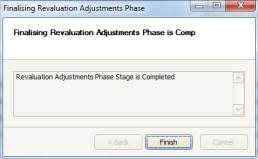

Click Finish.

The following screen will appear:

The system is now in a new financial year. Generate the AFR for the Car Parks. See below;

Closing the financial year is a Permanent action.

Note: Any updates to existing asset data prior to closing the Financial Year will be included as part of the financial year closed. Changes to inventory or condition that occur post 30/06/YYYY should only be updated after the financial year is closed.

It is recommended Users consult with their auditors and finance team as close as possible to 30/06/YYYY.